China Ends VAT Rebates on Solar Exports: What UK Solar Installers Must Prepare for in 2026

Introduction: A Turning Point for the Global Solar Market

The global solar industry is undergoing a structural shift. In a move that will reshape pricing, procurement, and project economics worldwide, China has announced the end of VAT rebates on solar exports, effective April 2026.

For UK solar installers, EPCs, developers, and commercial energy users, this is more than global policy news. It directly affects module prices, battery costs, supply chains, and long-term solar project viability.

This article explains what’s changing, how it impacts UK solar in 2026, and how installers can stay ahead, drawing on direct market experience from Sol4r Energy Ltd, a UK market leader across solar farms, commercial & industrial (C&I), and domestic installations, working directly with global manufacturers.

What Has Changed? (Explained Simply)

China previously offered export VAT rebates of up to 13% on photovoltaic (PV) products, including:

- Solar panels

- Inverters

- Balance-of-system (BOS) components

- Battery storage equipment

These rebates effectively subsidised exports, allowing Chinese manufacturers to undercut global pricing and flood international markets with ultra-low-cost hardware.

From April 2026, these rebates will be fully removed, signalling the end of artificially low export pricing and marking a shift toward a more sustainable, margin-aware global solar market.

Why This Matters to the UK Solar Industry

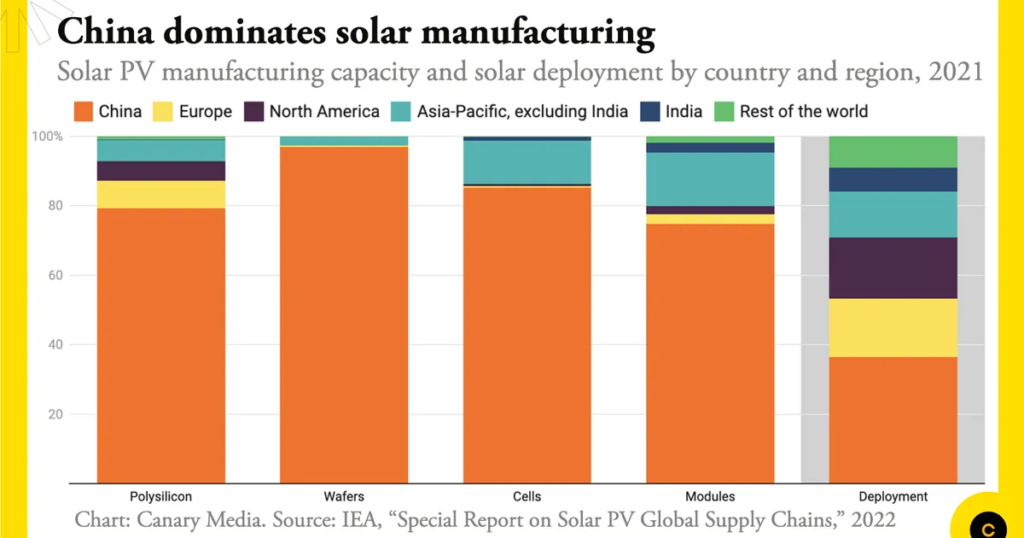

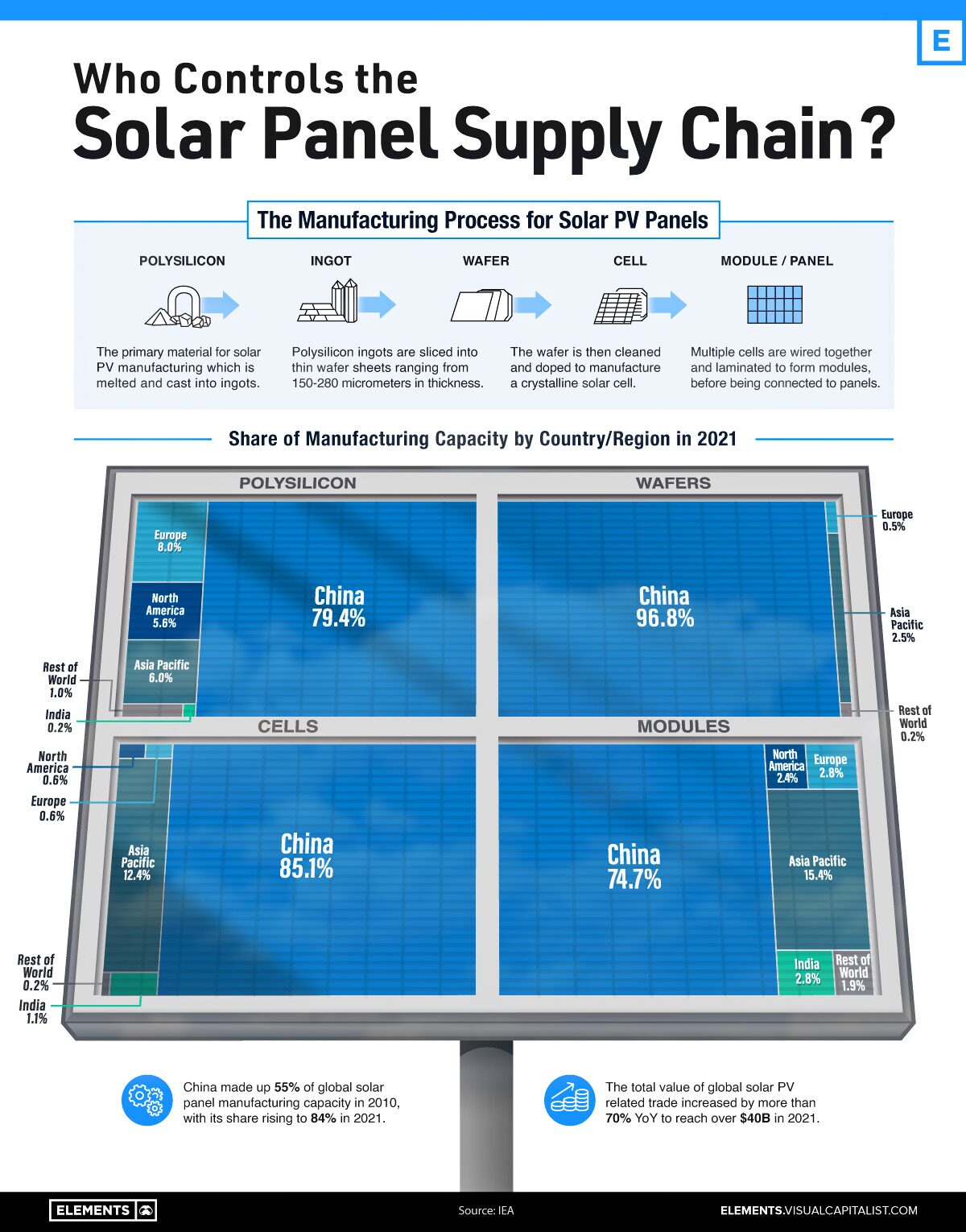

The UK solar market is heavily import-dependent:

- Over 80% of global solar modules originate from China

- Around 90% of lithium-iron-phosphate (LFP) battery cells are produced by Chinese manufacturers

As a result, any policy shift in China has a direct and immediate impact on UK solar project costs.

Installers with deep supply-chain visibility, such as Sol4r Energy Ltd, which works directly with manufacturers rather than relying solely on distributors are already seeing how procurement strategies must evolve ahead of 2026.

Expected Outcomes

- Higher landed costs for modules and batteries

- Reduced pricing volatility, but higher baseline pricing

- Increased importance of procurement planning and contract structure

Solar Equipment Pricing: What to Expect in 2026

Forecast impacts based on industry analysis and manufacturer guidance:

| Equipment Type | Expected Impact (2026) |

|---|---|

| Solar Modules | +5–10% price increase |

| Battery Storage | +8–15% increase |

| Inverters & BOS | Mild upward pressure |

| EPC Margins | Compression without repricing |

Key takeaway:

Solar will remain profitable, but margin errors will be punished. Installers operating without pricing discipline or supply certainty will feel pressure fastest.

How UK Solar Installers Should Prepare

1. Procurement Becomes a Strategic Advantage

Installers relying on spot purchasing will be most exposed. Competitive firms will:

- Secure forward pricing agreements

- Lock in supply early

- Diversify suppliers geographically

At Sol4r Energy Ltd, direct manufacturer relationships across solar modules, inverters, and storage allow better cost forecasting and reduced exposure to short-term price shocks, an approach that will become increasingly essential across the UK market.

2. Client Conversations Must Evolve

The long-standing narrative that “solar gets cheaper every year” is outdated.

Installers should reposition solar as:

- A long-term hedge against energy price volatility

- A carbon compliance and resilience tool

- A balance-sheet asset, not a short-term discount product

This shift is particularly important in commercial, industrial, and solar farm projects, where decision-makers already think in long-term asset cycles.

3. Contract Structures Will Tighten

Expect to see:

- Shorter price-lock periods

- Price-adjustment clauses tied to global supply factors

- Greater emphasis on shared risk mechanisms

This is especially relevant for C&I and utility-scale solar, where procurement timing can materially affect project viability.

4. Opportunity for Supply Chain Diversification

As price distortion reduces, this policy change could:

- Improve competitiveness of European manufacturers

- Accelerate Southeast Asian production growth

- Reduce long-term supply concentration risk

These benefits installers focused on quality, compliance, engineering depth, and delivery reliability rather than lowest-price installs.

Will This Slow Down UK Solar Deployment?

Unlikely.

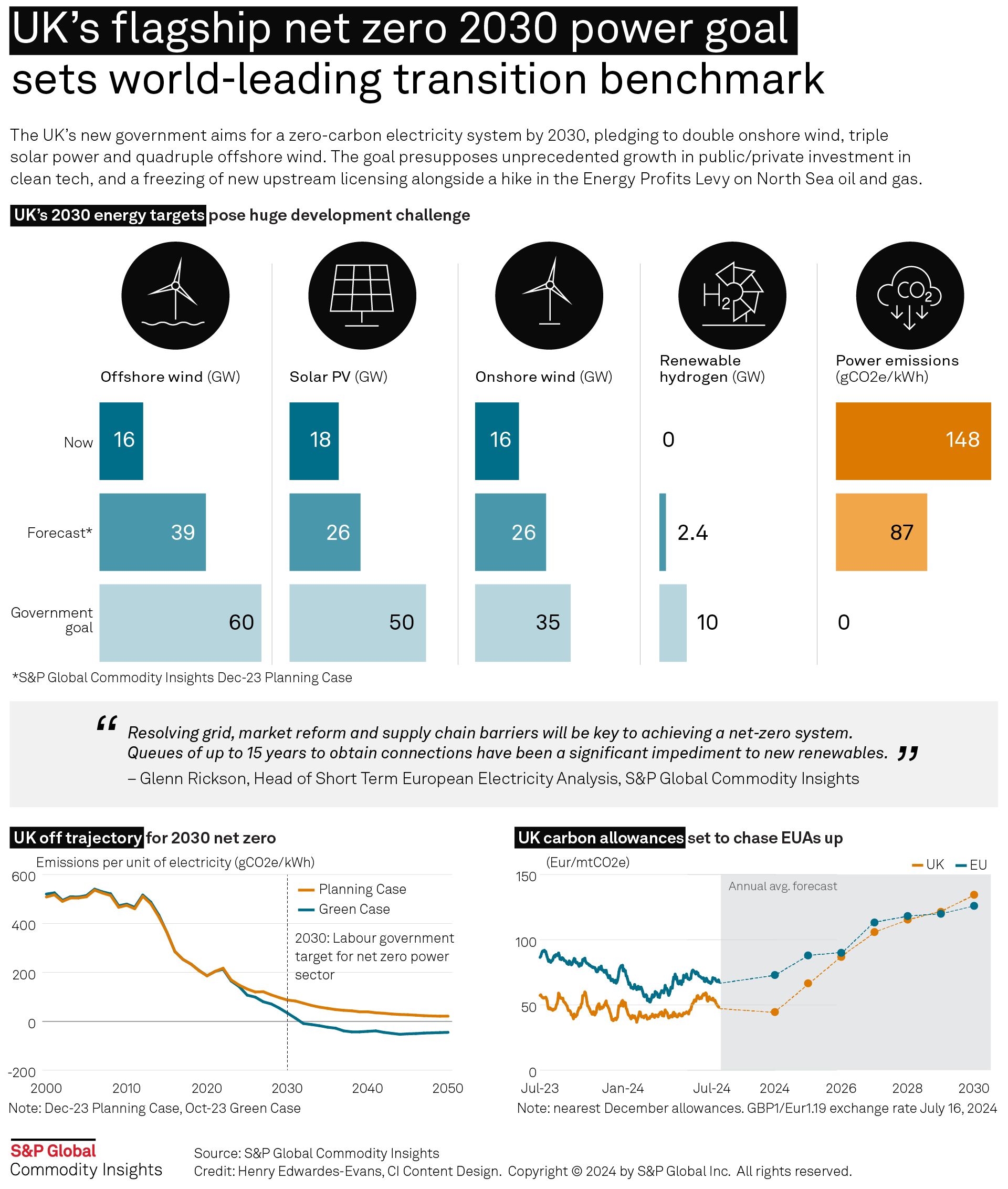

Demand drivers remain strong:

- High UK electricity prices

- Net Zero and ESG commitments

- Grid constraints and energy security concerns

- Rapid growth in battery storage and private-wire solutions

Rather than slowing deployment, the market will mature, rewarding professional EPCs with strong governance, procurement discipline, and engineering capability, an area where firms like Sol4r Energy Ltd are already positioned.

“The solar industry is no longer a race to the bottom on price. This shift marks the transition to a more stable, professional, and engineering-led UK solar market. Installers who adapt early will protect margins, credibility, and long-term growth.”

Charts & Data Point Suggestions

Chart 1: Global Solar Manufacturing Share

- China: ~80–85%

- Rest of Asia: ~10–12%

- Europe & Others: ~5–8%

Chart 2: Estimated Solar Cost Trend

- 2018–2023: Sharp decline

- 2024–2025: Flat

- 2026+: Gradual increase

Chart 3: UK Solar Value Drivers

- Energy price avoidance

- Carbon compliance

- Grid resilience

- Battery optimisation

Written by: Salah Khan